Mike Adapts to a Health Condition

Herramientas en esta página

Meet Mike

At the age of 45, Mike learns that he has the early signs of multiple sclerosis (MS). He decides to contact an MS support group to get advice on how having a disability might impact his life. There he gets ideas about how he can adjust his work and learns about health coverage options. He decides to leave his job as a writer at a newspaper and become a freelance writer, so that he can control his schedule better as he adapts to his disability. When he leaves his job, he signs up for the Arizona Health Care Cost Containment System (AHCCCS), because he no longer has employer-sponsored health coverage.

By the time he’s been working on his own for a few years, his work income has gone up, he’s started to put some money away for retirement, and he’s happy to know that he’s accumulating Social Security work credits so that if his disability gets worse and he needs Social Security Disability Insurance (SSDI), he’ll get it.

| Meet Mike | |

| Before disability: | |

| Name: | Mike |

| Age: | 42 |

| Disability: | None he knows of |

| Occupation: | Journalist at a newspaper |

| Income: | $3,500 per month ($42,000 annually) |

| Resources: | $4,000 in a savings account |

| Health coverage: | Employer sponsored |

| Adjusting to future disability: | |

| Age: | 45 |

| Disability: | Brain lesions indicating multiple sclerosis (MS) |

| Occupation: | Freelance writer |

| Income: | $1,250 per month ($15,000 annually) |

| Resources: | $2,000 in a savings account |

| Health coverage: | AHCCCS |

| Thinking about the long term: | |

| Age: | 48 |

| Disability: | Brain lesions indicating multiple sclerosis (MS) |

| Occupation: | Freelance writer |

| Income: | $3,000 per month ($36,000 per year) |

| Resources: | $4,000 in an IRA; $4,000 in savings |

| Health coverage: | Individual coverage purchased on CuidadoDeSalud.gov (HealthCare.gov) |

También

Conozca sus derechos y responsabilidades

Aprenda sobre las leyes que protegen los derechos de las personas con discapacidad.

Apoyos y adaptaciones en el empleo

Aprenda sobre las adaptaciones razonables y los programas que pueden ayudarle a trabajar.

AHCCCS para las personas con discapacidad

Hay más maneras de calificar para AHCCCS si tiene una discapacidad.

Mike Adapts to a Health Condition

- Le presentamos a Mike

- Mike Learns About His Disability

- Mike Adapts to His Disability

- Mike’s Income Goes Up

- How Mike Did It

- Próximos pasos

Herramientas en esta página

Mike Learns About His Disability

At age 42, Mike was a sports reporter at a local newspaper. He had always dreamed of covering the Diamondbacks, but his job wasn’t that glamorous — he worked at a community newspaper, the kind of paper that ran pictures of lost pets. He made about $42,000 per year, which wasn’t a lot, but he wasn’t married and had no kids, so it paid the bills.

One of the perks of his job was that he had employer-sponsored health coverage, but last year during open enrollment, Mike noticed that the health insurance options had changed some and the out-of-pocket expenses for employees were higher than they used to be. He talked to the paper’s Human Resources manager, Kelly, and asked her why things had changed.

Kelly replied, “Mike, the options we are able to offer each year can change, depending on how much insurers want to charge. Since our newspaper is in tough financial shape, we can’t contribute more to the monthly premium. We’ve tried really hard to offer a set of insurance options for employees to choose from, depending on their situations. Look over this information about the plans offered through our company to see which makes the most sense for you financially. You may also want to check in with your doctors to see what insurance they take.”

Kelly motioned at the paperwork, “Some of these plans are cheaper than others, but not all doctors are on any given plan. Also, their copayments and deductibles vary, so depending on how often you go to the doctor, you may want to choose one plan or another. You’ll have to decide what is important to you and balance some things.”

Mike followed Kelly’s advice. Open enrollment lasted for a couple of weeks, so he took his time to compare the 3 plans his job offered. He noticed that the Health Maintenance Organization (HMO) plan his job offered was the cheapest and that sounded good to him. Then he checked with his doctor at the time, whom he liked and trusted. The doctor’s office threw him a curveball — the doctor didn’t take HMO customers. The only coverage offered by Mike’s employer that his doctor accepted was the Preferred Provider Organization (PPO) plan.

Mike decided he wanted the cheaper plan, so he went ahead and signed up for the HMO. Even though he’d have to find new doctors, he wasn’t too worried, because he didn’t go to the doctor often and didn’t care that much if he had to change doctors. Over the following months, his work went well enough — he covered whatever his editors told him to write about, be that field hockey, soccer, or high school football. It wasn’t exactly his dream job, but it was an honest living. And, if he kept it up, maybe someday he’d be able to get a job at a big city paper.

Then, Mike began feeling a weird, persistent numbness on his left side. At first, he thought it was just the aches and pains of aging, but after a couple of weeks, he realized it was something more and that it was getting worse, so he went to his new doctor. The doctor didn’t have good news for Mike: tests showed that he had brain lesions, an early indicator of multiple sclerosis (MS). MS is a gradually debilitating neurological disorder that causes people to shake and lose mobility.

The doctor did offer Mike hope. He didn’t think Mike’s condition would be so bad that the writer would need to completely stop working, but he did think that Mike would have to make some changes in his life. In addition to beginning physical therapy, the doctor also suggested that Mike get in touch with a support group that could help him adjust to his new status as a person with a disability.

También

Conozca sus derechos y responsabilidades

Aprenda sobre las leyes que protegen los derechos de las personas con discapacidad.

Apoyos y adaptaciones en el empleo

Aprenda sobre las adaptaciones razonables y los programas que pueden ayudarle a trabajar.

AHCCCS para las personas con discapacidad

Hay más maneras de calificar para AHCCCS si tiene una discapacidad.

Mike Adapts to a Health Condition

- Le presentamos a Mike

- Mike Learns About His Disability

- Mike Adapts to His Disability

- Mike’s Income Goes Up

- How Mike Did It

- Próximos pasos

Herramientas en esta página

Mike Adapts to His Disability

Mike thought about what the doctor had said and about his own feelings. He contacted a local support group for people with MS and learned about how they had adjusted in similar situations. As he thought about things more and more, he decided he wanted to leave his job and just do some freelance writing for a while. With the changes he was going to be making in his life, he didn’t want to be tied down to a job running around from high school to high school to watch teenagers playing field hockey.

Mike called up the Human Resources person at his job, Kelly, and told her that he was going to leave. He knew that he could request reasonable accommodations to continue his work there, but after thinking long and hard about things, he knew that freelancing was the best for him for the time being. This was a major decision and he was afraid, because his job was how he got health insurance and he knew that freelance writing wouldn’t cover all of his medical bills. That’s one of the things he wanted to talk about with Kelly.

Mike asked, “Is there any way for me to stay on the company health plan, even though I won’t be working at the paper anymore?”

Kelly immediately replied, “Yes, you can stay on our plan, thanks to a federal law called COBRA. However, you’d have to pay the full monthly premium for it; we can’t pay the premium for ex-employees. You’ll get COBRA paperwork in the mail a few weeks after you stop working here.”

The next week, when Mike met with his multiple sclerosis support group, he mentioned the health insurance issue and asked what they did.

A member of the group named Jim spoke up, “That’s a good question, Mike. There’s been a lot of changes related to health insurance over the last few years and the situation is a lot better for people with disabilities than it used to be. When I left my job 2 years ago, I had to do COBRA, because otherwise I would’ve been denied insurance due to my pre-existing conditions caused by MS. But starting in 2014, private health insurers can’t deny you coverage or raise your premiums just because you’ve got a pre-existing condition. And, if you don’t make much money, either the government will help pay part of your monthly premium or you’ll qualify for government health coverage, like AHCCCS.”

Mike hoped that one of these options would work for him, since he didn’t know how well he’d do with his freelance work. He asked Jim where there might be more information about this.

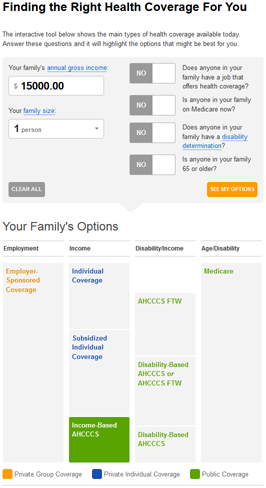

“Check out DB101.org,” said Jim. “It’s got a lot of articles about this stuff and a pretty neat little guide to health care that lets you punch in how much money you make and see what health coverage might be right for you. It’s a great way to get an initial grasp of what might work for you.”

Mike thanked Jim and checked out DB101. When he saw the Finding the Right Health Coverage for You interactive guide, he estimated that he’d make about $15,000 his first year as a freelance writer and he put that he lived alone. One of the questions asked if he had a disability determination. He didn’t yet, so he said no. When he had finished filling everything out, DB101 recommended that he look into “Income-Based AHCCCS.” Apparently, he’d probably qualify for free AHCCCS coverage!

Looking at DB101, he saw there were health coverage specialists available through CuidadoDeSalud.gov (HealthCare.gov) who could help him out. He followed the link for ayuda a nivel local and got the phone number for a nearby organization. Mike dialed the number and Andy, a trained expert in health coverage, answered. Andy confirmed what DB101 said: Mike would qualify for AHCCCS.

Mike asked, “Can you explain that question about the disability determination? Does MS count?”

“Those are good questions,” replied Andy. “There’s more than one way to qualify for AHCCCS if your disability meets certain standards. You answered the question correctly, since you do not have a disability determination, even though you have a disability. For adults, one of the requirements to be considered disabled by AHCCCS is that you be unable to earn much money. Since you are still able to work, you wouldn’t be considered disabled for the purposes of AHCCCS or most other disability-based benefits. If you like, you can read an explanation of the disability determination process on DB101. It is possible that if your disability gets worse at a later date and prevents you from working much, you could be determined disabled and start getting disability-based benefits like Social Security Disability Insurance (SSDI).”

Andy paused to see if Mike had any questions, then continued, “The good news for you is that AHCCCS covers many adults who are not determined disabled, including almost anybody whose family income is below 138% of the Federal Poverty Guidelines (FPG). And $15,000 a year is below the income limit for a one-person household, like yours, which is why you qualify. So, even though you do not have an official disability determination, you’ll qualify for free medical coverage that will be a big help with your disability-related medical needs.”

| Personas en el hogar: | |

Límites de ingreso para su familia: | |

| $15,650 | |

| $5,500 | |

| $15,060 | |

| $5,380 | |

| 230 | |

| AHCCCS por ingreso (138% FPG) | |

| AHCCCS KidsCare (230% FPG) | |

| Planes privados con subsidio, gastos reducidos (250% FPG) | |

| Planes privados con subsidio (no tiene límite) | -- |

Si el ingreso de su familia está por debajo del límite para un programa, podría calificar, si cumple con los demás requisitos del programa.

Aclaraciones:

| |

“Thanks for the information. How can I sign up?” asked Mike.

“Just go to CuidadoDeSalud.gov (HealthCare.gov),” said Andy. “It’s easy to apply there and you’ll get an immediate answer as to whether you qualify. Remember that if your income goes up in the future, you need to update your info on CuidadoDeSalud.gov (HealthCare.gov), so that you can keep getting the right type of health coverage for your situation.”

Mike went ahead and completed an application on CuidadoDeSalud.gov (HealthCare.gov) and just as Andy had said, he was approved for AHCCCS. Mike was very happy that he’d be getting free health coverage and could focus his mental energies on establishing himself as a freelance writer instead of worrying about how to pay his medical bills.

También

Conozca sus derechos y responsabilidades

Aprenda sobre las leyes que protegen los derechos de las personas con discapacidad.

Apoyos y adaptaciones en el empleo

Aprenda sobre las adaptaciones razonables y los programas que pueden ayudarle a trabajar.

AHCCCS para las personas con discapacidad

Hay más maneras de calificar para AHCCCS si tiene una discapacidad.

Mike Adapts to a Health Condition

Herramientas en esta página

Mike’s Income Goes Up

At first, Mike found that working for himself was hard. He had trouble getting freelance writing jobs and staying motivated to look for work. Eventually, he took some jobs doing boring technical writing, which helped cover his bills during his first year as a freelance writer. His guess about his income had been pretty spot on: he ended up making just a bit over $15,000 that year.

As time went on, though, he started making some baseball writing connections. Back in the old days, hustling up a job meant running around from office to office or ballpark to ballpark. But now Mike made his connections online by participating in baseball blogs, using his free time to write about stuff he really liked. During baseball season, Mike was able to watch multiple games on TV each day and he wrote about them for free on a small blog. Sometimes he just commented on the articles other people had written, often impressing the authors with his quick wit and cogent analysis.

By mid-season, he was becoming pretty well known on all of the Arizona Diamondbacks blog sites and his opportunity came up: one of the major blog writers was going on a maternity leave and they needed a substitute writer for the rest of the season. Mike submitted a sample article and was given a shot at a weekly column.

This was way more exciting than covering high school soccer, and he dedicated his full energies to his writing, producing better output than he ever had. Things went great, and by the time the season was over, he had become a real part of the local baseball writing scene. He didn’t want to have a full-time job at a single spot, though, because he wanted to be in control of his schedule and be able to work from home as a way of dealing with his disability, which little by little was limiting his physical strength. Instead, he used his new connections to get a series of freelance writing gigs and by the time spring training had started up the following February, Mike had a steady income writing about professional baseball. He didn’t make quite as much money as he did back at the paper, but he liked his work way more and the roughly $3,000 per month he was making was pretty good as far as he was concerned. He even opened up an Individual Retirement Account (IRA) and started putting some money into it each month.

When his income started going up, he realized that he might not qualify for AHCCCS anymore. He remembered that he was supposed to go back to CuidadoDeSalud.gov (HealthCare.gov) and update his information anytime his situation changed. He was a little confused about how to do this, so he decided to call CuidadoDeSalud.gov (HealthCare.gov) over the phone at 1-800-318-2596 o 1-855-889-4325 (TTY). They explained that he just had to log into the website and that when he updated his income information, CuidadoDeSalud.gov (HealthCare.gov) would let him know about any changes to his insurance.

“If your income has gone up so much that you don’t qualify for AHCCCS anymore, CuidadoDeSalud.gov (HealthCare.gov) will automatically notify you and help you enroll in an individual insurance plan from a private company.”

Mike thought about this and asked the CuidadoDeSalud.gov (HealthCare.gov) phone representative if this meant he’d have to pay a lot for his insurance.

“Probably not,” explained the CuidadoDeSalud.gov (HealthCare.gov) support person. “ I think you may qualify for tax subsidies for your individual insurance plan. That basically means that the government will help you pay the monthly premium if it’s too expensive. For example, if you get an average silver level plan, you’d only have to pay 8.5% of your income for the premium. If your plan has a higher premium, the government would pay the rest. So in your case, that means the most you’d pay for a plan would be $255 per month (8.5% of the $3,000 you make each month). You can get a more exact estimate of how much you might have to pay by using información sobre los planes de su zona proporcionada por CuidadoDeSalud.gov.”

This sounded like an affordable amount for Mike, now that he was making more money. He went ahead and updated his information on CuidadoDeSalud.gov (HealthCare.gov). When he did that, he got a message that because his income had gone up, he would no longer qualify for AHCCCS. Losing AHCCCS meant that he could sign up for a private insurance plan, even though it wasn’t the normal open enrollment period. He looked at the silver plans and some of them were actually cheaper than what he had been told over the phone. He considered them, but in the end decided to get a platinum level plan. A platinum level plan meant he’d have to pay a higher premium each month (more than $400 for the plan he chose), but with his multiple sclerosis, he wanted a plan that would have lower copayments and no deductible. Since he knew he’d need to see the doctor pretty often, the platinum plan would actually be cheaper for him in the end due to the lower out-of-pocket expenses.

There was one other thing Mike had learned about now that he was making more money with his self-employment: taxes. At first, Mike didn’t know much about filing self-employment taxes, so he asked another freelance baseball writer he met, Suzanne. She explained that as a self-employed person, Mike had to diligently pay his income and Social Security taxes.

“So how do I do that?” asked Mike.

Suzanne replied, “I don’t really know the details of it; I’ve got an accountant who handles it for me.” Suzanne then put Mike in contact with her accountant, Dana, who provided low-cost accounting services for people who were self-employed and had low to moderate income. He wasn’t very happy about having to pay taxes every 3 months, because when he worked at the paper, he only filed taxes once per year.

He mentioned this to Dana, who said, “Actually, when you worked at the newspaper, you were paying taxes all year, it’s just that it was automatic. Each time you got paid, some of your pay was sent to the government automatically. Your income taxes got sent to the Internal Revenue Service (IRS) and your Social Security and Medicare taxes were sent to the Social Security Administration (SSA). That’s why if you look at your old pay stubs, at the top you’ll see the full amount of your paycheck, which is called your gross income, while the actual direct deposits to your bank account were a fair amount smaller.”

Mike took a moment to think about this and then asked, “So what you’re saying is that when I worked for another company, every time I got paid, some of my money went to taxes. Now that I’m working for myself, I just have to pay those same taxes once every three months? What if I don’t want to pay those taxes until the end of the year?”

Dana explained that it was important to pay taxes on time to avoid problems with the IRS. She also pointed out that the Social Security and Medicare taxes were especially important, because each year he worked, he could get up to 4 Social Security work credits. “You have to keep getting Social Security work credits to collect Social Security Disability Insurance (SSDI) and get Medicare health coverage if your disability ever gets worse and you can’t work anymore. You also need work credits to get Social Security benefits when you retire. And, the more you earn and pay in Social Security taxes, the bigger your Social Security checks will be when you get them. So, paying these taxes is really an investment in your future.”

“Wow,” said Mike. “That’s a really good point and it’s good to think about taxes that way. I’m really happy to know that the more I work and earn, the more support I’ll get from Social Security when I need it.”

After that, Mike continued his freelance work and gave Dana paperwork every 3 months about his income, so that his taxes could get filed correctly.

También

Conozca sus derechos y responsabilidades

Aprenda sobre las leyes que protegen los derechos de las personas con discapacidad.

Apoyos y adaptaciones en el empleo

Aprenda sobre las adaptaciones razonables y los programas que pueden ayudarle a trabajar.

AHCCCS para las personas con discapacidad

Hay más maneras de calificar para AHCCCS si tiene una discapacidad.

Mike Adapts to a Health Condition

Herramientas en esta página

How Mike Did It

Mike was a journalist at a newspaper who discovered that he had a progressive disability, multiple sclerosis (MS). He adapted to his disability by leaving his job and becoming a freelance writer. When he did that, he lost his employer-sponsored health insurance, but was able to sign up for AHCCCS. During this process, he got support from many different people, including his former employer’s Human Resources department, a peer support group, benefits experts, and an accountant.

Mike took these steps to improve his situation:

- Got help from his employer’s Human Resources department so sign up for health insurance that paid for the medical care he got when he began feeling the effects of his disability

- Joined a support group for people with MS

- Decided to become self-employed

- Used DB101’s Finding the Right Coverage for You guide and learned that he probably qualified for AHCCCS

- Got CuidadoDeSalud.gov (HealthCare.gov) ayuda a nivel local over the phone to make sure he understood his options correctly

- Signed up for AHCCCS on CuidadoDeSalud.gov (HealthCare.gov)

- Networked with others in his field to find more freelance work and boost his income

- Started putting money away for retirement in an Individual Retirement Account (IRA)

- Contacted CuidadoDeSalud.gov (HealthCare.gov) at 1-800-318-2596 o 1-855-889-4325 (TTY) and then updated his information on the CuidadoDeSalud.gov (HealthCare.gov) website

- Got help from an accountant to make sure that all self-employment income taxes and Social Security taxes were paid on time

With his freelance work, Mike had the freedom to work at the pace he wanted and as time went on, he achieved success in his field. He had health coverage and also felt secure knowing that by paying his Social Security taxes, he’d be covered by Social Security Disability Insurance (SSDI) if his disability got worse.

También

Conozca sus derechos y responsabilidades

Aprenda sobre las leyes que protegen los derechos de las personas con discapacidad.

Apoyos y adaptaciones en el empleo

Aprenda sobre las adaptaciones razonables y los programas que pueden ayudarle a trabajar.

AHCCCS para las personas con discapacidad

Hay más maneras de calificar para AHCCCS si tiene una discapacidad.

Mike Adapts to a Health Condition

Herramientas en esta página

Next Steps

El Boleto para Trabajar

El programa del Boleto para Trabajar del Seguro Social ayuda a personas con discapacidades que reciben beneficios del Seguro Social a reincorporarse a la fuerza laboral y hacerse más independientes. El programa del Boleto para Trabajar ofrece acceso gratis a servicios relacionados con empleos, tales como capacitación, transporte y rehabilitación vocacional. Puede llamar a la línea de ayuda del programa del Boleto para Trabajar al 1-866-968-7842 o 1-866-833-2967 (TTY).

El programa del Boleto para Trabajar del Seguro Social ayuda a personas con discapacidades que reciben beneficios del Seguro Social a reincorporarse a la fuerza laboral y hacerse más independientes. El programa del Boleto para Trabajar ofrece acceso gratis a servicios relacionados con empleos, tales como capacitación, transporte y rehabilitación vocacional. Puede llamar a la línea de ayuda del programa del Boleto para Trabajar al 1-866-968-7842 o 1-866-833-2967 (TTY).

Obtener más información

Obtenga más información sobre AHCCCS:

- En el artículo de DB101 AHCCCS

- En su oficina local oficina de DES/Administración de Asistencia para Familias

- En la página web de AHCCCS.

Obtenga más información sobre cómo adquirir cobertura médica individual:

- En el artículo de DB101 titulado Buying Health Coverage on CuidadoDeSalud.gov (HealthCare.gov)

- En CuidadoDeSalud.gov (HealthCare.gov). También puede llamar a CuidadoDeSalud.gov (HealthCare.gov) al 1-800-318-2596 o 1-855-889-4325 (TTY).

- Obteniendo ayuda a nivel local.

Obtenga más información acerca del Seguro de Incapacidad del Seguro Social (SSDI):

- En el artículo de DB101 sobre Seguro de Incapacidad del Seguro Social (SSDI)

- En la página web de la Administración del Seguro Social

- En su oficina del Seguro Social

Obtenga más información sobre los impuestos al trabajo por cuenta propia:

- En el Servicio de Rentas Internas (IRS) Centro de Impuestos para Personas que Trabajan por Cuenta Propia

- Asistiendo a una serie de video de nueve lecciones acerca de los impuestos a pequeñas empresas

- Accediendo a una página web de preparación de impuestos gratis

- Busque un contador que puede ayudarle

Servicios de asesoría sobre beneficios e incentivos de trabajo

Si usted está recibiendo beneficios de SSI, SSDI o CDB ahora y anda buscando empleo, debe de ser elegible para recibir servicios de asesoría gratis. Los consultores/as de incentivos de trabajo del programa Benefits 2 Work Arizona podrán ayudarle a comprender los incentivos de trabajo del Seguro Social, los programas de beneficios para personas con discapacidad y la manera en que el trabajo los afecta. El objetivo de estos servicios es ayudarle a evitar complicaciones mientras usted desarrolla un plan financiero sostenible para su futuro.

Usted puede comunicarse con el programa Benefits 2 Work llamando al teléfono 1-866-304-WORK (9675) para localizar a un/a consultor/a de incentivos de trabajo que preste servicios en su comunidad. La llamada es gratis.

AZ LINKS – Un Centro de Recursos para Personas Discapacitadas

|

El sitio web AZ Links del Centro de Recursos para Personas Discapacitadas y de la Tercera Edad (ADRC) ayuda a personas de edad avanzada, a personas discapacitadas, a los miembros de sus familias y al personal que las cuida a localizar recursos y servicios que puedan satisfacer sus necesidades para la vida independiente, su discapacidad, sus necesidades de vivienda, económicas y de salud. |

Localice servicios en su comunidad

Busque información utilizando estos enlaces:

- Sistema de Control de los Costos de Atención Médica de Arizona (Arizona Health Care Cost Containment System —AHCCCS)

- Grupos dedicados a proteger los derechos de las personas con discapacidades

- Información y/o asesoramiento sobre seguros de salud

- Seguro de Incapacidad del Seguro Social (Social Security Disability Insurance —SSDI)

También

Conozca sus derechos y responsabilidades

Aprenda sobre las leyes que protegen los derechos de las personas con discapacidad.

Apoyos y adaptaciones en el empleo

Aprenda sobre las adaptaciones razonables y los programas que pueden ayudarle a trabajar.

AHCCCS para las personas con discapacidad

Hay más maneras de calificar para AHCCCS si tiene una discapacidad.